franklin county ohio tax deed sales

Ad Vast library of fillable legal documents. Adoptable Dogs Animal Control.

The Essential List Of Tax Lien Certificate States

In an effort to recover lost tax revenue tax delinquent property located in Franklin Ohio is sold at the Warren County tax sale.

. 572119 and Tax Lien Certificates see notes Sec. Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Such public record requests may be directed to.

Get Started in Minutes. Tax Deeds are sold to the bidder with the highest bid. For tax lien certificates investors can get yields as high as 18 per annum with a one year right of redemption.

Tax Deed Sale Sec. The Franklin County Treasurer holds the states first and best lien against real property located in Franklin County. Office Closed in Observance of Labor Day.

Adult Protective Services Office on Aging. Franklin county justice system unclaimed sales proceeds report. Franklin County Treasurers Office.

862022 - Vet ID. Franklin County Treasurer - Property Search. Get information on a Franklin County property and view your tax bill.

Ad Unsure Of The Value Of Your Property. Veteran Grave Search Recorder. The tax deed foreclosure auctions in Ohio counties are lumped in with the sheriff sales.

Columbus Ohio 43215 Get Directions. Find All The Record Information You Need Here. Tax Deeds are sold to the.

The Franklin County Sales Tax is collected by the merchant on all qualifying sales. In Ohio the County Tax Collector will sell Tax Deeds to winning bidders at the Franklin County Tax Deeds sale. Franklin County Clerk of Courts ClerkFranklinCountyOhioGov 6145253600.

The property is sold to the successful bidder state laws differ though often it is sold for the amount of unpaid taxes. Look for lien certificate auctions in Franklin County Columbus Cuyahoga County Cleveland and Hamilton County Cincinnati. Cards at Ohio Women Veterans Conference Visit our table at the conferences resource expo in the Archie M.

Ohio is unique in that it offers both tax lien certificates and tax deeds. This list consists of extra court. Get Record Information From 2021 About Any County Property.

High St Columbus OH 43210 from 930 AM to 500 PM to register or renew your Veteran ID. De graff oh 43318. New Monthly Real Estate Sales Dashboard.

PO Box 571 Hamilton MT 59840 877 982-9725. Geographic Information System Auditor. Wb property investors llc co timothy j mcgrath esq.

6439 county road 64. Franklin Countys mediation program to resolve property value disputes is the first of its kind in the state of Ohio. The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales tax and 175 Franklin County local sales taxesThe local sales tax consists of a 125 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

By emailing the Franklin County Treasurer you may obtain an email listing of properties included in the tax lien certificate sale. 572119 and Tax Lien Certificates see. Make sure to bring your DD-214 discharge forms if you are recording them for the first time.

Register and Subscribe now to work with legal documents online. Successful bidders at the Warren County Ohio tax deed sale receive an Ohio tax deed. Floor 23 Columbus Ohio 43215 6145253600 Excess Funds Access Information.

373 South High Street 17th Floor. Look for lien certificate auctions in Franklin County Columbus Cuyahoga County Cleveland and Hamilton County Cincinnati. Excess Sale Proceeds.

Our office receives many requests for a list of case filings with excess funds. 123 Main Parcel ID. Marriage Licenses Probate Court.

Tax Deed Sale Sec. After a lien is sold if all lien charges and interest are not fully paid after one year the tax lien holder has the right to. 614-525-4663 HOME Ohio Board of Tax Appeals Case Search.

According to state law the sale of Ohio Tax Deeds are. Administration Offices 373 S. The Tax Incentives Hub is a one-stop shop for information about current property tax incentives in Franklin County.

HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306. Generally the minimum bid at an Franklin County Tax Deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. Franklin County Sheriffs Office.

Griffith Ballroom of the Ohio Union 1739 N. For tax lien certificates investors can get yields as high as 18 per annum with a one year right of redemption. Best tool to create edit share PDFs.

Decisions from 1982 - present. 373 South High Street. The Delinquent Tax Division holds an annual tax lien sale to collect outstanding delinquent taxes.

John Smith Street Address. Become a member of the Tax Sale Resources Research platform today. Ad Find Tax Foreclosures Under Market Value in Ohio.

Old Orchard Cottage Circa 1774 Like A Secret Garden One Acre In West Virginia 274 900 The Old House Life Old House Old Houses House

The Essential List Of Tax Lien Certificate States

Tax Sale Lists Richmond County Tax Commissioners Ga

This 1907 Beauty In Franklinton Va Is For Sale For Only 329 000 The Old House Life

Tax Foreclosure Sales Katherine J Kelich Belmont County Treasurer

I Owe Ohio Sales Tax But Never Even Made A Sale J M Sells Law Ltd

Sheriff S Sales Allegheny County Sheriff S Office

Ohio Foreclosures And Tax Lien Sales Search Directory

Franklin County Treasurer Auctions Tax Foreclosure Sales

How To Find Tax Delinquent Properties In Your Area Rethority

How To Find Tax Delinquent Properties In Your Area Rethority

Sales And Use Information For Vendors Licensing And Filing Department Of Taxation

Purchasing A Tax Lien In Georgia Brian Douglas Law

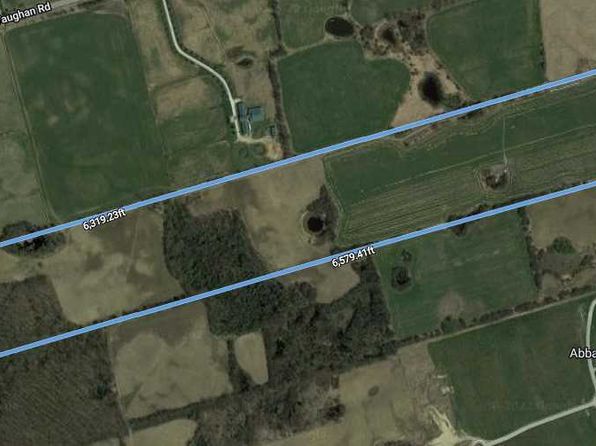

Vaughan On Luxury Homes For Sale 773 Homes Zillow

Ontario Tax Sale Results Tri Target Com